Secure Your Daughter’s Future with Punjab & Sind Bank’s Sukanya Samriddhi Account

Every parent dreams of providing their child with the best future. If you are a parent to a girl, ensuring financial security for her education, marriage, or other milestones becomes even more important. Punjab & Sind Bank’s Sukanya Samriddhi Account offers a practical and secure way to turn those dreams into reality.

With features designed to help you save and grow funds over time, this scheme is a smart step toward securing your daughter's future. Let’s break down the details in a simple yet professional manner.

What is the Sukanya Samriddhi Account?

The Sukanya Samriddhi Account is a special savings scheme offered by Punjab & Sind Bank to support the financial needs of young girls. It encourages parents to save for their daughter's future.

From opening the account to making deposits and withdrawals, the scheme is designed to be simple and easy to understand. You can open this account at any Punjab & Sind Bank branch across India, ensuring easy access to your funds.

If you're looking for Sukanya Samriddhi Account updates or want to know how to open a Sukanya Samriddhi Account online, this guide will simplify everything for you.

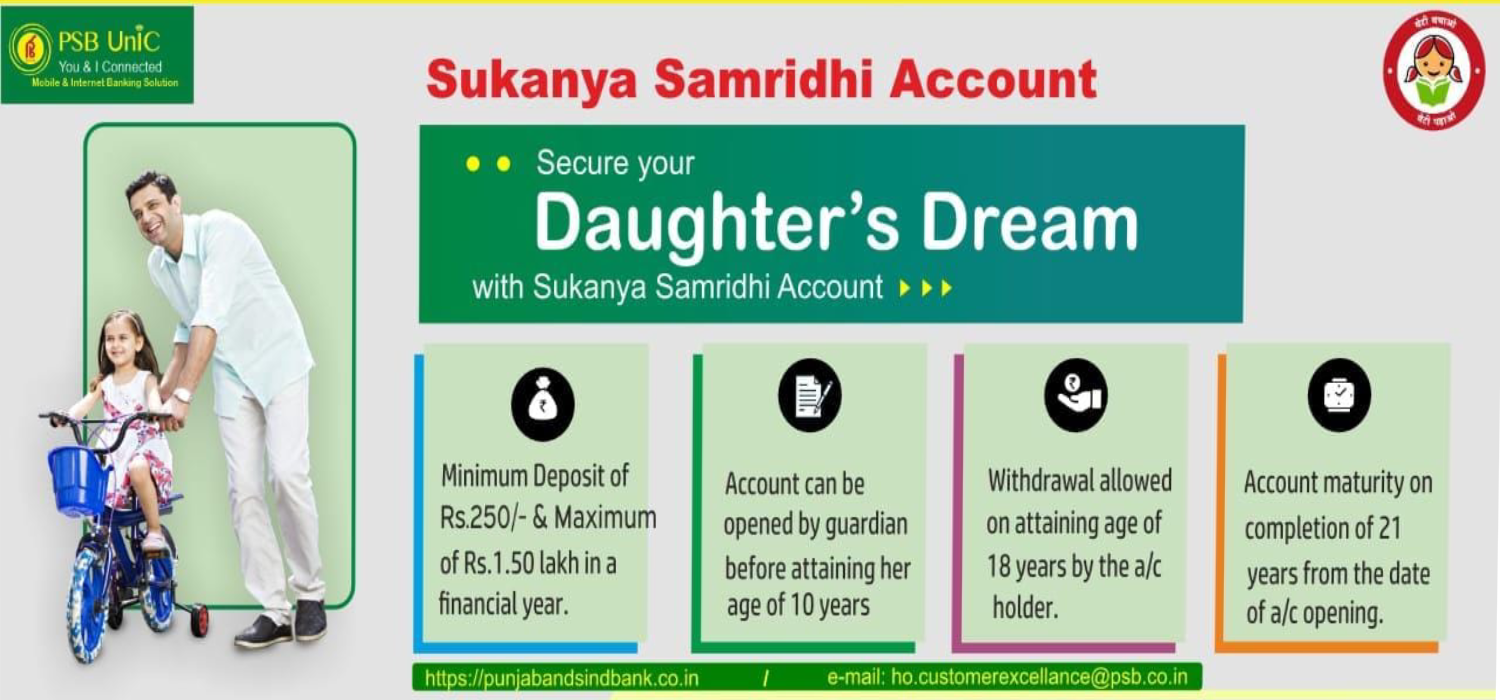

How to Open a Sukanya Samriddhi Account & Key Features

Let’s explore the main features of this scheme and how it benefits you and your daughter:

1. Eligibility to Open the Account

- Who can open the account? Any parent or legal guardian can open the account in the name of a girl child.

- Age limit: The account must be opened before the girl turns 10 years old.

- One account per girl child: Only one account is allowed per child, ensuring focused savings.

- Maximum number of Account in a family:A family can open accounts for up to two girl children under this scheme. However, if twins or triplets are born in the first or second birth order, additional documents accounts can be opened with proper documentation.

2. Minimum Deposit Amount

The scheme is designed to be accessible for families from all financial backgrounds:

- Minimum deposit: ₹250 to open the account.

- Additional deposits: Can be made in multiples of ₹50.

- Annual deposit requirement: A minimum of ₹250 must be deposited each financial year to keep the account active.

3. Attractive Interest Rates

- The government periodically updates the interest rate.

- Interest is compounded annually, allowing your savings to grow faster.

- For instance, if the current interest rate is 7.6% (subject to government revisions), your deposits will compound annually, offering better returns than many other savings options.

4. Maximum Deposit Limit

- You can deposit up to ₹1,50,000 per financial year, ensuring significant fund growth.

- This flexible limit helps families save at their own pace while maintaining financial discipline.

5. Withdrawals for Key Milestones

This scheme recognizes the importance of education and marriage in a girl’s life:

- Partial withdrawal of up to 50% of the account balance is allowed once the girl turns 18 years old.

- This amount can be used for higher education or marriage expenses, ensuring financial support at crucial times.

6. Account Maturity

- The account matures 21 years from the date of opening, allowing long-term savings.

- The total balance, including interest, is paid to the account holder upon maturity.

- If the account holder gets married before 21 years, the funds can be withdrawn, provided she is at least 18 years old.

7. Easy Transfers Across India

If you relocate, the account can be easily transferred from one Punjab & Sind Bank branch to another, ensuring seamless accessibility.

Why Choose Punjab & Sind Bank’s Sukanya Samriddhi Account?

1. Secure & Transparent

The scheme is backed by the Government of India, ensuring transparency and security.

2. Encourages Systematic Savings

Small but regular deposits grow into a substantial fund over time, thanks to compounding interest.

3. Tailored for Your Daughter’s Needs

Whether for education, marriage, or major life events, this scheme ensures funds are available when needed.

4. Easy Accessibility

With Punjab & Sind Bank’s wide branch network, managing the account is simple and convenient.

You can also explore how to open a Sukanya Samriddhi Account online for added convenience.

How to Open a Sukanya Samriddhi Account

Step 1: Visit Your Nearest Punjab & Sind Bank Branch/Through PSB UnIC

Find the branch closest to you and Speak to the bank staff about opening a Sukanya Samriddhi Account or the existing customers can also open online through PSB UnIC app.

Step 2: Submit the Required Documents

Ensure you have the following documents ready:

- Birth certificate of the girl child.

- Parent’s or guardian’s ID proof (Aadhaar card, PAN card, etc.).

- Address proof (utility bill, Aadhaar, passport, etc.).

Step 3: Make the Initial Deposit

- Deposit a minimum of ₹250 to activate the account.

- You can increase your savings by adding funds in multiples of ₹50 at any time.

Step 4: Start Saving

- Regularly deposit funds to meet the annual minimum deposit requirement of ₹250.

- Stay updated with Sukanya Samriddhi Account news for any scheme changes.

Can You Open a Sukanya Samriddhi Account Online?

Yes, an existing customer can open a Sukanya Samriddhi Account online through the PSB UnIC app; however, a new customer requires a visit to the Punjab & Sind Bank branch. However, once the account is opened, you can:

- Set up standing instructions via Net Banking for hassle-free deposits.

- Track and manage your account online for convenience.

⚠ Note: If you fail to deposit the minimum amount per year, the account will be marked as ‘Account Under Default’. An account under default may be regularised on payment of a penalty of fifty rupees per year alongwith the such minimum specified amount for the year or years of default.

Additional Benefits of Saving with Punjab & Sind Bank

Punjab & Sind Bank offers:

- Expert financial advice to help you grow your savings.

- Digital banking services to manage your account from anywhere.

- Continuous support to help you secure your child’s future.

- Experience hassle free transaction and instant availability of online account statements with the PSB UnIC App.

Conclusion

Investing in your daughter’s future is one of the most meaningful steps you can take as a parent.

Punjab & Sind Bank’s Sukanya Samriddhi Account is designed to help you build financial security with flexible deposits, attractive interest rates, and milestone withdrawals. Start today and give your daughter the financial foundation she deserves.

Visit your nearest Punjab & Sind Bank branch or check their official website to learn more about this life-changing savings opportunity.

FAQs

Q: What is the Sukanya Samriddhi Account?

A: It is a government-backed savings scheme for girl children under 10 years old, ensuring financial security for their future.

Q: How much can I deposit?

A: You can deposit a minimum of ₹250 and a maximum of ₹1,50,000 per financial year.

Q: What documents are required?

A:

- Sukanya Samriddhi Account Opening Form

- Birth certificate of the girl child

- Parent’s or guardian’s ID proof

- Address proof

Q: Can I open the account online?

A: Yes, an existing customer can open a Sukanya Samriddhi Account online through the PSB UnIC app; however, a new customer requires a visit to the Punjab & Sind Bank branch.

Q: When does the account mature?

A:

It matures 21 years from the date of opening or when the account holder gets married after turning 18.

Start saving today for a secure and prosperous future for your daughter!