How to Invest to Avoid Paying Taxes:Best Tax-Saving Schemes at Banks

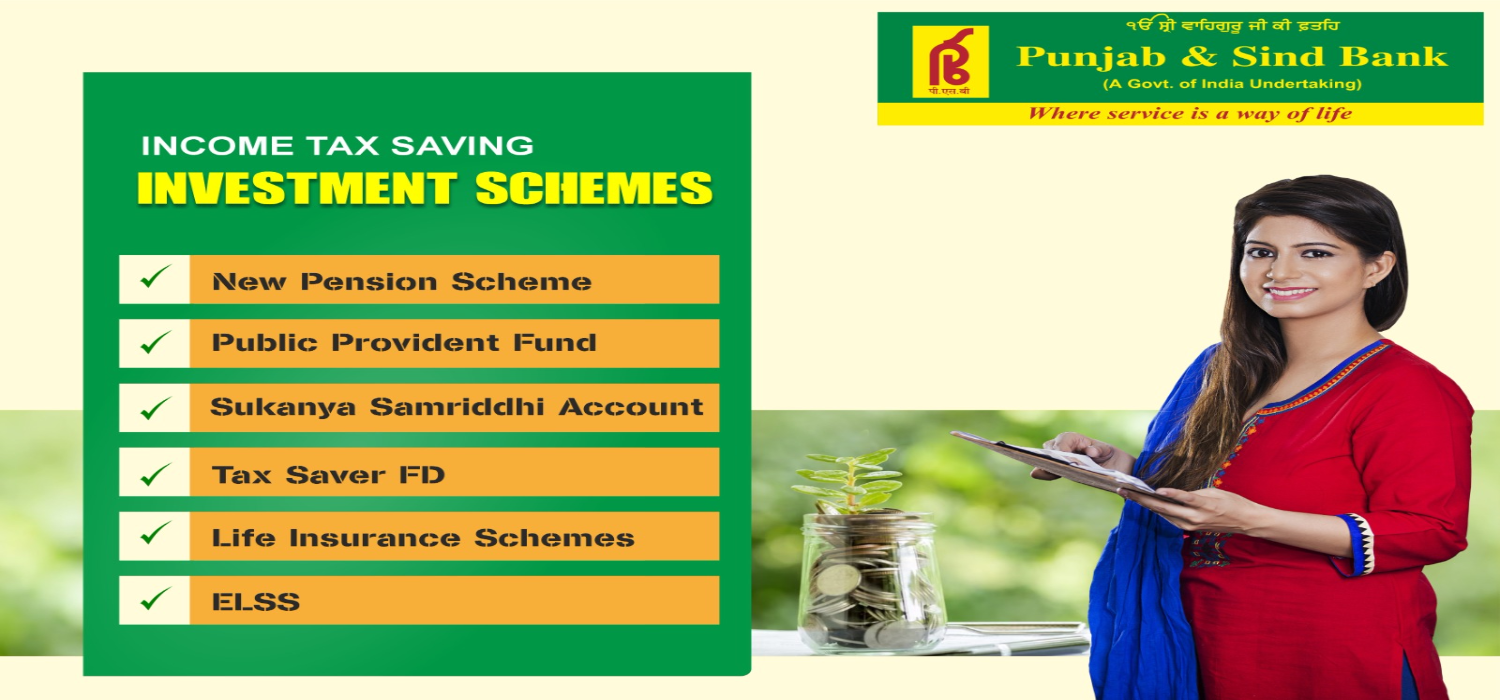

Investing wisely not only helps you grow your wealth but also allows you to save on taxes. Punjab & Sind Bank offers some of the best tax-saving schemes that are safe and secure for your investments. In this blog, we’ll explore Income-tax-saving schemes available at banks, enabling you to achieve financial growth while reducing your tax liability.

Understanding Tax-Saving Investments

Tax-saving investments are designed to reduce your taxable income, helping you pay less tax on your hard-earned money. These schemes are governed by provisions of the Income Tax Act.

Choosing the right tax-saving scheme is essential for ensuring financial stability and long-term growth.

Punjab & Sind Bank is a trusted institution in the financial sector, offering a variety of tax-saving schemes to meet your financial needs. Below are some of the top government-backed tax-saving schemes you can explore.

Top Tax-Saving Schemes at Banks

1.Public Provident Fund (PPF)

The Public Provident Fund (PPF)is one of the most trusted tax-saving schemes, popular across all age groups. Backed by the government, it ensures secure and guaranteed returns.

- Investment Limit: Start with as little as ₹500 and invest upto ₹1.5lakh annually.

- Tax Benefits: Contributions are eligible for tax deductions under Section 80C under old tax regime and the interest earned is tax-free.

- Maturity Period: The maturity period is 15 years, with an option to extend for 5 more years.

PPF also allows partial withdrawals after six years and loans against the account balance from the 3rd to the 6th financial year, making it ideal for long-term planning.

2.Senior Citizen Savings Scheme (SCSS)

Specifically designed for individuals aged 60 and above, the Senior Citizen Savings Scheme (SCSS) offers income and tax benefits with the security of government backing.

- Investment Limit:Upto ₹30 lakh.

- Interest Rate: Paid quarterly, ensuring regular income.

- Maturity Period: 5 years, extendable by 3years(request has to be submitted with in one year from maturity)

Deposits under SCSS qualify for Section 80C deductions, though the interest earned is taxable .It is a reliable choice for retirees seeking financial security and peace of mind. Non-Resident Indians (NRIs) and Hindu Undivided Families (HUFs) are not eligible to open a SCSS.

3.Sukanya Samriddhi Account (SSA)

Designed to secure the future of the girl child, the Sukanya Samriddhi Account (SSA)supports education and marriage planning with excellent tax benefits.

- Investment Range:₹250 to ₹1.5lakh annually.

Tax Benefits: Contributions are deductible under Section 80C, and interest earned is tax-free.

Maturity Period: 21 years or until the girl child marries after the age of 18.

SSA is the best tax-saving option for parents looking to secure their child’s future while earning good returns.

4.PSB Fixed Deposit Tax-Saver Scheme

Punjab & Sind Bank’s Tax-Saver Fixed Deposit is a trusted investment under the best tax-saving schemes category.

- Lock-in Period: 5 years.

- Tax Benefits: Investments are eligible for Section 80C deductions under old tax regime. It’s a simple way to make your money grow while paying less tax. However, interest amount is taxable and no premature or auto-renewal facility is available.

This scheme offers guaranteed returns with minimal risk, making it a suitable choice for conservative investors. The scheme does not provide any loan facility to the customers.

5.National Pension System (NPS)

The National Pension System is a flexible, government-backed investment plan ideal for retirement planning.

- Tax Benefits: Contributions upto₹1.5lakh are deductible under Section 80 C under old tax regime, with an additional ₹50,000 deduction under Section 80CCD (1B).

NPS invests your money across different assets, such as equities and government bonds, offering diversified growth for long-term financial stability.

6.Life Insurance

Punjab & Sind Bank makes it easy for you to get life insurance along with your banking needs. They have tied up with trusted insurance companies like LIC of India, SBI Life Insurance, and Bajaj Allianz Life Insurance to offer plans like endowment, money-back, and whole-life policies. These plans help you save money, protect your loved ones, and grow your wealth. With this service, you can take care of your banking and insurance in one place, hassle-free.

Disclaimer:

- The contract will be between you and the insurance company, not with the bank.

- Punjab & Sind Bank acts only as a licensed corporate agent (License No.CA0391) without any risk participation.

7.ELSS (Equity Linked Savings Scheme) with Punjab & Sind Bank

Punjab & Sind Bank, through its partnership with trusted fund managers, offers customers the opportunity to invest in ELSS (Equity Linked Savings Scheme). It is the only category under Mutual Funds offering tax benefit. ELSS is a great option for customers looking to save taxes under Section 80C while enjoying the potential for higher returns through equity investments. With a short lock-in period of just 3 years, ELSS is one of the most flexible and rewarding tax-saving investments. Customers can start investing with as little as ₹500, making it accessible and convenient for everyone.

Features:

- Tax Benefits: Save taxes up to₹1.5lakh annually under Section 80C of the Income Tax Act.

- Short Lock-In Period: Only 3 years, offering liquidity sooner compared to other tax-saving options.

- Growth Potential: Invest in equity markets to earn higher returns over the long term.

- Affordable Investment: Start your ELSS journey with just ₹500 through SIPs or a lump sum.

- Convenient Access: Track and monitor your ELSS investments anytime, anywhere through the PSB UNIC app.

- Expert Fund Management: ELSS funds are managed by professional fund managers, ensuring diversified and optimized investments.

Why Choose Punjab & Sind Bank for Tax-Saving Schemes?

Punjab & Sind Banks stand out for their personalized services and secure financial solutions. Here’s why they are ideal for exploring government tax-saving schemes:

- Diverse Options: From PPF to fixed deposits, bank offers a variety of schemes to suit different financial needs.

- Government-Backed Security: Most schemes are backed by the Government of India, ensuring safety and reliability.

- Ease of Access: Open accounts easily at your nearest branch or online.

- Attractive Returns: Competitive interest rates help you grow your savings.

How to Open an Account?

Opening an account under any of these tax-saving schemes is simple:

- Visit the nearest branch or the official website.

- Submit required documents such as identity proof, address proof, and photographs.

- Complete the application form and deposit the minimum required amount.

Bank representatives are available to assist you throughout the process, ensuring a hassle-free experience.

Additional Tips forTax-Saving Investments

- Start Early: Early investments benefit from compound returns.

- Diversify: Invest in a mix of schemes to align with your financial goals.

- Plan Your Taxes: Understand tax-saving options and choose schemes that best meet your needs.

Conclusion

Punjab & Sind Bank’s tax-saving schemes can help you reduce your tax burden while achieving financial security. By investing in these reliable, government-backed schemes, you can secure your future, plan for retirement, or grow your finances. Start investing today and make your money work smarter for you!

Note: Tax laws are subject to change. Consult a financial advisor or tax professional for personalized advice.

FAQs

Q: What are the best tax-saving schemes for beginners?

A: Options like the Public Provident Fund (PPF) and tax-saving fixed deposits are ideal for beginners. These schemes are simple, secure, and offer tax benefits under Section 80C.

Q: Are government tax-saving schemes safe for long-term investments?

A: Yes, government tax-saving schemes like PPF and Sukanya Samriddhi Account (SSA) are secure and offer guaranteed returns, making them excellent for long-term savings.

Q: How much can I save in taxes using these schemes?

A: You can save up to ₹1.5lakh under Section 80C and an additional ₹50,000 under Section 80CCD (1B) through schemes like NPS.

Q: Can I invest in more than one tax-saving scheme?

A: Yes, you can diversify your investments across multiple schemes to align with your financial goals and maximize tax savings.