Mobile banking (also known as M-Banking) is a term used for performing balance checks, account transactions, payments etc. via a mobile device such as a mobile /cell phone.

Yes, PSB Mobile Banking Services are available to all the Retail customers of Bank.

Mobile Banking facilitates the customers for availment of banking services round the clock with the help of mobile telecommunication devices. Customers can access bank accounts i.e. can check account balance, transfer funds, make bill payments etc through their mobile handset.

You need to have account with the Bank, a valid mobile connection and handset supporting the services.

No, the PSB Mobile Banking Services are accessible through presently available Service Providers.

You can register for the Mobile Banking Services by submitting request on the required application form at any Bank branch.

The user can download PSB m-Pay application (mobile app) in his mobile handset. The application can be downloaded (free download) from android market using the link PSB mobile banking service Google>Playstore>Category Finance. It is also available for Windows and I phone store.

Browser based and Application based:

- Balance Enquiry

- Mini Statement

- Inter Bank Fund Transfer (NEFT)

- Immediate Payment System (IMPS)

- Bill Payment

- Mobile Recharge

- DTH Recharge

- Institution Fee Payment

- Temple Donation

- Cheque Status

- Stop Cheque

- Change

- Password/Pins

USSD-(Unstructured Supplementary Services Data)

- View Balance

- Account Details

- Online Mini Statementi

- Self transfer of funds

- Third Party Transfer of funds

- Changing Login Passwords

The application does not allow other user to login with your credentials.

Please check for typing error in mPin field.

Please make sure that you have entered the login name correctly. Even when your login name is correct, check with Bank that you have been enabled for mobile banking

This error is shown when the password has been entered wrongly for a number of times (5), Please ensure that you have typed your password correctly.

This could be an issue to GPRS settings. Please choose an appropriate plan for GPRS connectivity.

This could be an issue due to loss of connectivity to the server. Please restart the application and try.

Change your phone settings to allow to enter numbers on the keypad

Please contact the concerned branch immediately and get the Mobile Banking Service de-registered.

Regarding the application that is stored in the mobile:

In case of Browser based Mobile Banking - no information is stored and therefore no problems

In case of Application based Mobile Banking It is not possible to read the information that is stored on mobile without the credentials.

Yes. Please contact the concerned branch for updating mobile number

Bank does not levy any charges, however please consult your service provider for the data plan and charges.

When you launch your application (when there is good signal) you can verify if your last transaction was successful or not by doing an activity inquiry

Yes. Whether GSM or CDMA, if your mobile device has the pre - requisites as mentioned in point 4, you can use mobile banking.

Yes, you will be able to use the services on national as well as international roaming.

Yes. both outgoing and incoming messages are encrypted and secured.

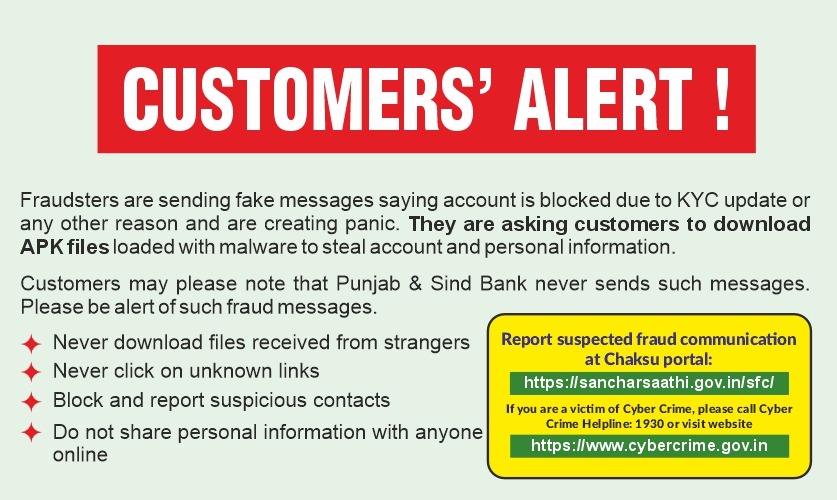

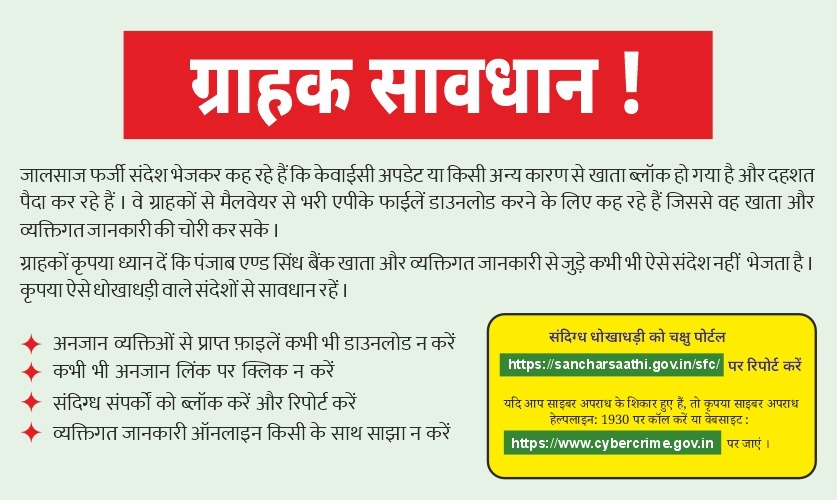

- Do not reveal password(s over phone, mail etc to any person including Bank.

- The passwords can be changed as frequently as you wish. Please change your password(s) before the passwords get expired or when the system prompts you to do so.

- Do not click on website links/attachments in unknown/suspicious emails. These links may take you to replica of banks website and ask for keying in your user id and password(s).

- Bank will never send any e-mail requesting to provide user id assword and other sensitive information.

- In case of doubt, reconfirm the PSB s website by double clicking the ‘padlock’ symbol/icon at the bottom right of the web page to ensure the site is running in secure mode before you input any confidential/sensitive information.

- Clicking on the 'padlock' symbol/icon and server certification symbol will display details of the server certification in the favor of Punjab and Sind Bank

Switch off your mobile and restart the application. And check the transactions made through Activity Inquiry service.

Either one of the below options should be performed if the older version of application is still present in the mobile.

- Delete the older app

- An alert message saying Do you want to keep the existing application data with yes and no options message will be displayed. User should select No and then continue the downloading process.

User can answer the call/check the message and then continue the banking operation.

It is Offline

200-250 KB memory space is required in the mobile for running the Mobile banking application successfully.

MPIN is a secure pin which is used to validate the user in addition to the Mobile banking password. User should providea MPIN while downloading the client. And when the user launches the downloaded application in the mobile, user would be requested to enter the MPIN, which user provided while downloading the client. User would be able to login into the application only if he provides the correct MPIN.

User sets his/her own mPIN during registration process.

Yes. Once the user is logged into the mobile banking, he would be able to change the mPIN through "Change mPIN" service.

MPIN should have 4 characters. It should be numeric.

The internet connection speed of mobile handsets varies depending on different factors such as network coverage, service provider, location, connection type and handset model.

Yes. Internet banking and mobile banking are different Channels. Hence you can access both simultaneously

As a security measure, PSB Mobile Banking will autom atically log out if you leave your mobile phone idle for more than 8 minutes. If you try to proceed with any transaction after you have been logged out, your phone will display - Session Expired message.

Go to the settings option of your mobile and uninstall the applicaion.

You can re-download the application by logging into PSB Mobile Banking site.

Ideally transaction can be completed within 5-10 secs for Application and Browser based and 20-30 sec for USSD flavor. But it depends upon GPRS connectivity of your service provider.

Presently, limit is set as Rs 25,000/-per day per customer.

The transactions through Mobile Banking Services happen instantaneously i.e. in real time and there is no option for stopping, reversing or recalling the same.

There is no registration required for self and third party transfer of funds.

No receipt will be generated but only success/failure message will be displayed on screen. You will receive a SMS for transaction

Yes, you can use IMPS option for Inter - bank transfers.

Yes, the facility is available in the mobile Banking

Yes. All Android phone user can donate the money through Mobile. The facility is not available in the Windows and iPhone

Yes, You can stop cheque through PSB Mobile Banking.

For more details regarding the same call our 24*7 helpline number 1800-419-8300